What is a Medicare Supplement (MediGap)?

Medicare Supplement is a type of health insurance sold by private insurers to cover the 20% cost that Original Medicare will not cover. Medicare Supplement is also known as “Medigap” or “Medigap Plans”

Medicare Supplement Insurance (Medigap) policy also helps pay some of the health care costs that Original Medicare doesn’t cover, like:

- Co-payments

- Coinsurance

- Deductibles

Medigap policies are sold by private companies.

Some Medigap policies also cover services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, here’s what happens:

- Medicare will pay its share of the Medicare-approved amount for covered health care costs.

- Then, your Medigap policy pays its share.

It also depends on which policy you choose from the standard offered plans that determine what your Medicare Supplement plan will cover.

Get More Medicare Information

The first step to setting Medicare the right way is knowledge. Let us help you learn your basic benefits. Call Us our help is always 100% free.

10 Things You Must Know About Medicare Supplement Policies

- You must have Medicare Part A and Part B

- A Medicare Supplement policy is different from a Medicare Advantage Plan. Medicare Advantage plans are ways to get Medicare and Prescription Drug Plans all in one plan, while a Medicare Supplement policy only supplements your Original Medicare benefits

- You pay the private insurance company a monthly premium for your medicare Supplement policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare

- A Medicare Supplement policy only covers one person. If you and your spouse both want coverage, you’ll each have to buy separate policies

- You can get a Medicare Supplement from Nevada Medicare – Nevada Medicare contracts with all the carriers approved in the State of Nevada

- Any standardized Medicare Supplement policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medicare Supplement policy as long as you pay the premium

- Medicare Supplement policies sold after January 1, 2006 aren’t allowed to include prescription drug coverage. If you want prescription drug coverage, you have to get a stand alone Medicare Prescription Drug Plan (Part D)

- You can drop your supplement at any time. There is no annual election period for Medicare Supplement plans

- The Annual Election Period (AEP) in the fall is for drug plans. It does not apply to Medicare supplements in any way

- Some carriers offer household discounts if two or more people enroll in Medicare supplemental plans from the same company

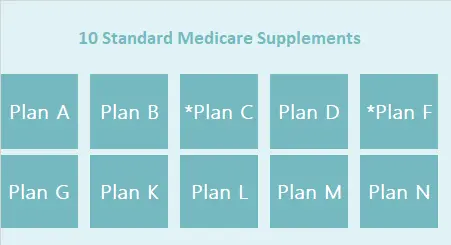

The 10 Standard Medicare Supplements

The cost of Part B is set by Social Security and it changes from year to year. Individuals in higher income brackets pay more than those in lower incomes brackets. How much you pay is determined by your adjusted gross income reported to the IRS in recent years.

10 Standard Medicare Supplement Plans

Every one of these policy plans provides the same set of benefits from insurance company to insurance company. The only difference between each supplement plan with the same letter is the monthly premium. The plans that gets the most requests for quotes are Medigap Plans F, G and N.

*Medicare Supplement Plan C & F will no longer be available for beneficiaries that turn 65 after January 1, 2020. If you become eligible for Medicare on or after January 1, 2020, you won’t be able to buy Plan C or F. If you already have Plan C or F, don’t worry – you can generally keep your plan. You can apply to buy Plan C or F if you become eligible for Medicare before 2020.

Contact Us and find out the insurance companies available in in Nevada so you can compare the rates.

What Part B Covers?

- Part B covers 2 types of services:

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts assignment. Call us and we can go over the preventative services that are available from the carriers in Nevada.

Part B also covers things like:

- Clinical Research

- Ambulance Services

- Durable Medical Equipment (DME)

- Mental Health

- Inpatient

- Outpatient

Get More Medicare Information

Do you need help understanding Medicare coverage? Let us help you learn your basic benefits. Call Us our help is always free.

What is Medicare Part C?

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are an “all in one” alternative to Original Medicare (Government). They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have Medicare. These “Bundled” plans include Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance, and usually Medicare prescription drug (Part D).

To enroll in a Part C plan, you must be enrolled in both Medicare Parts A and B.

You must live in the plan service area.

The most important element of Medicare Advantage or Part C is that it is not Original Medicare (Government). It is an alternative to Original Medicare and is managed by private insurers. This means that once you enroll, your Medicare coverage will come from the Advantage plan itself, and no longer from the government.

There are 2 ways to get medicare:

- Original Medicare (Government) 80% + Medicare Supplement (Private Insurance Companies) 20% + Prescription Drug Plan (Private Insurance Companies)

- Medicare Advantage (Private Insurance Companies)

This is a choice whether you wish to join a Medicare Advantage Plan or just stay with your original Medicare A & B and enrolling in Medicare Supplement Plan. Call us and we can help you determine the best path that will work for you.

Who provides coverage?

Private insurance companies approved by Medicare like UnitedHealthCare, Humana, Anthem, Aetna, etc.

How come I do not enroll in it at Social Security like A & B?

Because Part C is voluntary. Some people prefer to get their Medicare coverage from Original Medicare (Government) and traditional Medicare Supplement plans. Others do not mind being in a network and like having just one plan that includes all of the services provided by Original Medicare, Prescription Drug Plan, Dental, Vision and other Wellness benefits all wrapped into one plan with one monthly premium.

How do you choose your providers?

We can help you determine the best plans in your area and personalize it to your needs. You choose the one the works best for you.

- How much does it cost?

- You usually pay a low to no monthly premium for your MA Plan (in addition to your monthly Part B premium).

- You may pay a co-payment or coinsurance for covered services. Many MA plans offer vision, hearing, and dental coverage. Costs, extra coverage, and rules vary by plan.

- Plans have a yearly limit on your out-of-pocket costs. Once you reach a certain limit, you’ll pay nothing for covered services for the rest of the year.

- Your out-of-pocket costs may be lower in an MA plan.

Medicare Advantage Plans cover all Medicare services

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you’re always covered for emergency and urgently needed care.

The plan can choose not to cover the costs of services that aren’t medically necessary under Medicare. If you’re not sure whether a service is covered, check with your provider before you get the service.

Most Medicare Advantage Plans offer coverage for things that aren’t covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, meal plans, and other health-related services that promote your health and wellness.

Plans can also tailor their benefit packages to offer these new benefits to certain chronically ill enrollees. These packages will provide benefits customized to treat those conditions. Check in with us to see what benefits are offered on every plan available in Nevada.

Most include Medicare prescription drug coverage (Part D).

Drug coverage in Medicare Advantage Plans

Most Medicare Advantage Plans include prescription drug coverage (Part D).

- You may be able to join a stand-alone prescription drug plan if you enroll in a plan that does have prescription drug plan:

- Can’t offer drug coverage (like Medicare Medical Savings Account plans)

- Choose not to offer drug coverage (like some Private Fee-for-Service plans)

- You’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these occur:

- You move out of the plan’s service area.

- You join a separate Medicare Prescription Drug Plan.

Get More Medicare Information

The first step to setting Medicare the right way is knowledge. Let us help you learn your basic benefits. Call Us our help is always 100% free.

What is Medicare vs Medicaid?

Medicare and Medicaid are two separate, government-run programs. They are operated and funded by different parts of the government and primarily serve different groups.

- Nevada Medicaid is a Nevada state-run program that provides hospital and medical coverage for people with low income.is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income.

- Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income.

If you are eligible for both Medicare and Medicaid (dually eligible), you can have both. They will work together to provide you with health coverage and lower your costs. In this case, Medicare is primary and Medicaid is secondary.

Also know that while Medicare and Medicaid are both health insurance programs administered by the government, there are differences in covered services and cost-sharing. Make sure to call 1-800-MEDICARE or contact your local Medicaid office to learn more about Medicare and Medicaid costs and coverage, especially if you are a dual-eligible.

The government has several Savings Programs which you can apply for through Nevada’s Medicaid office. These may help you to pay your Part B premiums. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage.

Do You Qualify To Have Your Medicare Part B Premium Paid For By The State Of Nevada?

If you do, you will receive your $185 back into your Social Security Check. You may also qualify for the Extra-Help program from Social Security.